Help Article | UPI Participants' roles and responsibilities

- NPCI owns and operates the Unified Payments Interface (UPI) platform.

- NPCI prescribes rules, regulations, guidelines, and the respective roles, responsibilities and liabilities of the participants, with respect to UPI. This also includes transaction processing and settlement, dispute management and clearing cut-offs for settlement.

- NPCI approves the participation of Issuer Banks, PSP Banks, Third Party Application Providers (TPAP) and Prepaid Payment Instrument issuers (PPIs) in UPI.

- NPCI provides a safe, secure and efficient UPI system and network.

- NPCI provides online transaction routing, processing and settlement services to members participating in UPI.

- NPCI can, either directly or through a third party, conduct audit on UPI participants and call for data, information and records, in relation to their participation in UPI.

- NPCI provides the banks participating in UPI access to system where they can download reports, raise chargebacks, update the status of UPI transactions etc.

- PSP Bank is a member of UPI and connects to the UPI platform for availing UPI payment facility and providing the same to the TPAP which in turn enables the end-user customers / merchants to make and accept UPI payments.

- PSP Bank, either through its own app or TPAP’s app, on-boards and registers the end-user customers on UPI and links their bank accounts to their respective UPI ID.

- PSP Bank is responsible for authentication of the end-user customer at the time of registration of such customer, either through its own app or TPAP’s app.

- PSP Bank engages and on-boards the TPAPs to make the TPAP’s UPI app available to the end-user customers.

- PSP Bank has to ensure that TPAP and its systems are adequately secure to function on UPI platform.

- PSP Bank is responsible to ensure that UPI app and systems of TPAP are audited to safeguard security and integrity of the data and information of the end-user customer including UPI transaction data as well as UPI app security.

- PSP Bank has to store all the payments data including UPI Transaction Data collected for the purpose of facilitating UPI transactions, only in India.

- PSP Bank is responsible to give all UPI customers an option to choose any bank account from the list of Banks available on UPI platform for linking with the customer’s UPI ID.

- PSP Bank is responsible to put in place a grievance redressal mechanism for resolving complaints and disputes raised by the end-user customer.

- TPAP is a service provider and participates in UPI through PSP Bank.

- TPAP is responsible to comply with all the requirements prescribed by PSP Bank and NPCI in relation to TPAP’s participation in UPI.

- TPAP is responsible to ensure that its systems are adequately secure to function on the UPI platform.

- TPAP is responsible to comply with all applicable laws, rules, regulations and guidelines etc. prescribed by any statutory or regulatory authority in relation to UPI and TPAP’s participation on the UPI platform including all circulars and guidelines issued by NPCI in this regard.

- TPAP has to store all the payments data including UPI Transaction Data collected by TPAP for the purpose of facilitating UPI transactions, only in India.

- TPAP is responsible to facilitate RBI, NPCI and other agencies nominated by RBI/NPCI, to access the data, information, systems of TPAP related to UPI and carry out audits of TPAP, as and when required by RBI and NPCI.

- TPAP shall facilitate the end-user customer with an option to raise grievance through the TPAP’s grievance redressal facility made available through TPAP’s UPI app or website and such other channels as may be deemed appropriate by the TPAP like email, messaging platform, IVR etc.

WhatsApp

Features

TEXTS

Simple,

Reliable Messaging

Message

your friends and family for free*. WhatsApp uses your phone's Internet

connection to send messages so you can avoid SMS fees

GROUP

CHAT

Groups to

keep in touch

Keep in touch with the groups of people that matter the most, like your family or coworkers. With group chats, you can share messages, photos, and videos with up to 256 people at once. You can also name your group, mute or customize notifications, and more.

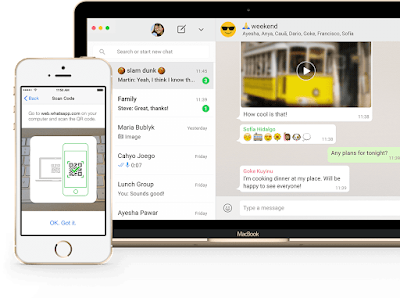

WHATSAPP

ON WEB AND DESKTOP

Keep the

Conversation Going

With

WhatsApp on the web and desktop, you can seamlessly sync all of your chats to

your computer so that you can chat on whatever device is most convenient for

you. Download the desktop app or visit web.whatsapp.com to get started

WHATSAPP

VOICE AND VIDEO CALLS

Speak

Freely

With

voice calls, you can talk to your friends and family for free*, even if they're

in another country. And with free* video calls, you can have face-to-face

conversations for when voice or text just isn't enough. WhatsApp voice and video

calls use your phone's Internet connection, instead of your cell plan's voice

minutes, so you don't have to worry about expensive calling charges.

* Data

charges may apply. Contact your provider for details.

END-TO-END

ENCRYPTION

Security

by Default

Some of

your most personal moments are shared on WhatsApp, which is why we built

end-to-end encryption into the latest versions of our app. When end-to-end

encrypted, your messages and calls are secured so only you and the person

you're communicating with can read or listen to them, and nobody in between,

not even WhatsApp.

PHOTOS

AND VIDEOS

Share

Moments that Matter

Send

photos and videos on WhatsApp instantly. You can even capture the moments that

matter to you most with a built-in camera. With WhatsApp, photos and videos

send quickly even if you're on a slow connection.

DOCUMENTS

Document

Sharing Made Easy

Send PDFs, documents, spreadsheets, slideshows and more, without the hassle of email or file sharing apps. You can send documents up to 100 MB, so it's easy to get what you need over to who you want.

VOICE

MESSAGES

Say

What's On Your Mind

Sometimes,

your voice says it all. With just one tap you can record a Voice Message,

perfect for a quick hello or a longer story.